Profiting from doing nothing

Most investors are looking for strategies that profit if prices move. Surely it is nice to ride a stock upwards. But for the last 15 years calculated by movements of the DAX-Index it was not a successfull approach. He who bought at 8000 points in 2000 is looking at a level of 10.000 points 15 years after, a yield of just 25 % for 15! years equivalent to a meager 1,66% p.a. without reinvestment or even less (about 1,5% taking reinvestment into account). Lots of investor ignore the fact that markets can go sideways for longer than wanted. Buying at the lows is an excellent setup but hardly ever achieved (even though our company has some good tools to hint in this direction), but we are certainly not even close to an after crash low. Better accept the reality and profit from it. If stocks go sideways strategies that profit from such movement are the right ones. How to profit if nothing moves? Selling options to other market participants is teh answer. An option is a financial contract traded on an exchange that enables to option buyer to buy a stock at a certain price over a period of time (Call-Option) or to sell it (Put-Option).

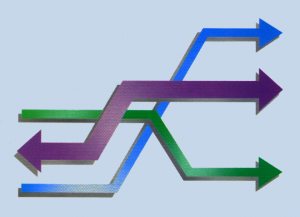

Assumin g a stock trades at the € 100 level. If we could find somebody that is interested to buy (call) at € 100 (strike) and pay us € 5,- as an option´s premium and somebody else speculating beigelegtenthat prices fall looking for a € 100-Put paying the same premium of € 5 we receive € 10 in income. Ome option always expires. If the pürice in gthe future at expiry is € 95, the call buyer will not exercise his right to buy at € 100 and in turn at € 105 the put buyer will stay away from selling to us at € 100.

So only if the price climbs above 110 or falls below 90 we are encounztering an overall loss. Even at 107 for example the call buyer will exercise his right to buy from us at 100 make a profit of 2 (taking into acccount that he had to pay 5 to be able to buy at 100 and now may sell at 107) and we loose 2 on this leg of the position, but as we received the other option premium tooihr whoch fully expires worthless to the put buyer we sare still running an overall profit. We have to buy at 107 and deliver at 100 making a loss of 7 but in turn have received 10 in options premia yielding an overall gain of 3 still.

Using such strategies an investor may create a broad span of prices in between every outcome is profitable. Further positive effect: As long as the setup works no further action is neccessary. Earning by doing nothing.